St James’s Church has achieved a lot in its 150 plus years and the future is exciting, but that future is in our hands. Maintaining the building, expanding our ministry and supporting charities all cost money. The Church of England encourages us to give 5% of our net income to the church and a similar amount to other work that helps to build God’s kingdom. This is consistent with the biblical principle of the tithe. Only with a regular, budgeted income can future activities be undertaken.

Donations to St James's

If you would like to make a gift to St James's then there a variety of ways:

- through our online giving portal - click here

- by bank transfer: to the PCC of St. James’s Church, Hampton Hill, Santander Bank

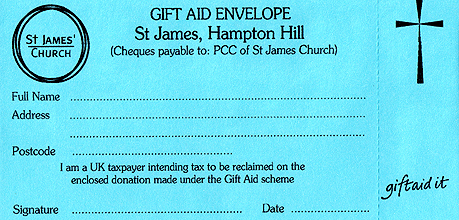

Sort Code: 09-01-55 A/c No: 23968604 - cash or cheque placed in a blue gift aid envelope (available in the church)

If you are able to Gift Aid the donation, we can then can claim tax back!

Regular giving to St James's

The best way you can give to St James’s Church is by standing order or direct debit via the Parish Giving Scheme. This allows the church to plan with greater certainty of income. If you are a tax-payer we can reclaim gift aid on your donations so please complete a gift aid declaration.

Parish Giving is a Direct Debit scheme that claims Gift Aid on our behalf. Giving can optionally be index linked. All donations are transferred back to the parish each month plus any gift aid that is claimable. Information packs are available from the Parish Office.

If you would prefer to give by Standing Order you can download a form here. It is simple to complete and we will set it up for you. Alternatively the form includes our bank details and you can set up your own standing order via online banking.

An alternative way of giving is by using the the blue gift aid envelopes. Some people choose to put cash in the collection plate. We also have the option of contactless card payments via a card reader.

Gift Aid

If you gift aid your payment, every £1 you give is worth £1.25 because St James’s Church can reclaim from the government the tax paid on the money you give. This is at no cost to you. If you are a higher rate taxpayer you can claim a personal tax benefit, which means every £1 you give will cost you only 75p. To enable us to reclaim the tax and increase the value of our gift you should complete the Gift Aid Declaration.

The Finance & Planned Giving Team

The Finance Team supports the treasurer in relation to giving, recommending a budget to the PCC, reviewing the accounts prior to inspection and supporting stewardship / giving campaigns. In particular it is concerned with the planned giving income, the decision of the amount of the Common Fund allocation to the Diocese and the allocation to charities. It works closely with the planned giving team as neither the Church of England as a central organisation nor its individual parish churches receive any public funds. St James's receives its income from offertory collections, donations, fund raising activities and by hiring out its properties. However, the chief source of income is from the regular giving of the members of the Planned Giving Scheme, which together with the tax refund that can be recovered on this money, brings in nearly 70% of the income.

|

|

|